Any house is the realization of a dream, but that dream only begins to materialize when a person’s name is scripted on an allotment letter of property. A builder or housing authority issues the allotment letter, which does not merely allocate a flat or plot but also details the financial, legal, and construction obligations of both parties. It is not flashy, but it is the bottom line.

Whether one is getting home loans, protecting one’s interests, or merely filing documents, the allotment letter of the property is the first milestone.

Let us analyze its components, formatting principles, and how omitting any clause can prove costly.

Allotment Letter Meaning: Explained Simply

The allotment letter introduces the cost of the property, the payment plan, and information about the buyer; therefore, the allotment letter is an important aspect of the document. It is generally issued after the buyer has deposited the booking amount or some initial deposit.

Simply put, the allotment letter’s meaning is anchored in acknowledgment and commitment. An allotment letter is proof of allotment of a particular property to the buyer and lays out the transaction details such as description of property, payment schedule, construction schedules, and other terms and conditions mutually agreed upon.

See also: What Factors To Keep in Mind Before Buying A Home In Bangalore?

When is the Allotment Letter Issued?

Generally, the allotment letter is issued once the booking amount is paid, and the buyer has expressed his intention to purchase the property is, therefore, a pre-sale confirmation, signifying the sale, before the signing of more formal agreements such as the Builder-Buyer Agreement or Agreement to Sell.

Thus, it must be understood that not all allotment letters are legal title documents; nevertheless, they play an important role in aligning buyers’ rights during the initial phase of a property transaction.

Allotment Letter of Property: Key Contents You Must Check

A standard allotment letter for property typically contains the following important details:

- Name and Address of the Buyer and Builder/Authority

- Project Name and Location

- Unit Number or Plot Number Allotted

- Super Built-up Area or Plot Size

- Total Cost of the Property

- Break-up of the Payment Schedule

- Applicable Taxes and Charges

- Construction Timeline and Completion Date

- Terms and Conditions

- Signatures of Both Parties

It must be understood that some allotment letters also have annexed conditions regarding the cancellation policy, penalty for delay in payments, and escalation clauses in the case of price rise.

See also: Property Investment Tips for First-time Buyers

Why is an Allotment Letter Important in Property Transactions?

Proof of Transaction

The allotment letter of property is a written acknowledgment that the builder has allotted a certain unit to the buyer. This is more binding than just a simple letter; it is the first document which creates a formal relationship between the two parties.

Aid in Home Loan Approval

Even in the case of banks and housing finance companies, the allotment letter is one of the main requirements for processing applications. Allotment letters are seen as a contractual notice that the pacts are ended, and therefore, the buyer and the seller reach an informal agreement of a certain kind.

Reference for Legal Compliance

The property-with-allotment-letter sometimes serves as a reference for further compliance regarding documents such as registration of property or possession letters that need to be applied for, especially in cases involving government-allotted schemes or cooperative housing societies.

Transparency and Trust

A well-written letter of allotment guarantees that all the terms and conditions are set down in a transparent manner, protecting the buyer from surreptitious charges or last-minute changes. It sets the stage for a fair and transparent transaction.

Is an Allotment Letter Legally Binding?

Yes, but not without the limitation.

Allotment letters are seen as a contractual notice that the pacts are ended and therefore, the buyer and the seller reach an informal agreement of a certain kind. However, it does not provide ownership rights nor a registered document under the Indian Property Act. It would serve as an exhibit(s) in support of a case or for establishing some of its terms.

Thus, the buyer must ensure that either a sale deed or an agreement to sell is executed and registered to perfect, pass, and convey the title or ownership to them, depending on the nature of the transaction.

Property Allotment Letter vs. Sale Agreement: What’s the Difference?

Both documents are important in the property purchase process, but they have separate functionalities.

| Feature | Allotment Letter | Sale Agreement |

| Issued When | After the booking amount is paid | When a majority of the terms of payment are accepted |

| Legal Status | Not registered, partly enforceable | Legally binding and registered |

| Purpose | Confirms allotment of property | Confirms the terms of the property sale |

| Ownership Rights | No | No, but legally secures the buyer’s interests |

| Required for Home Loans | Yes | Yes |

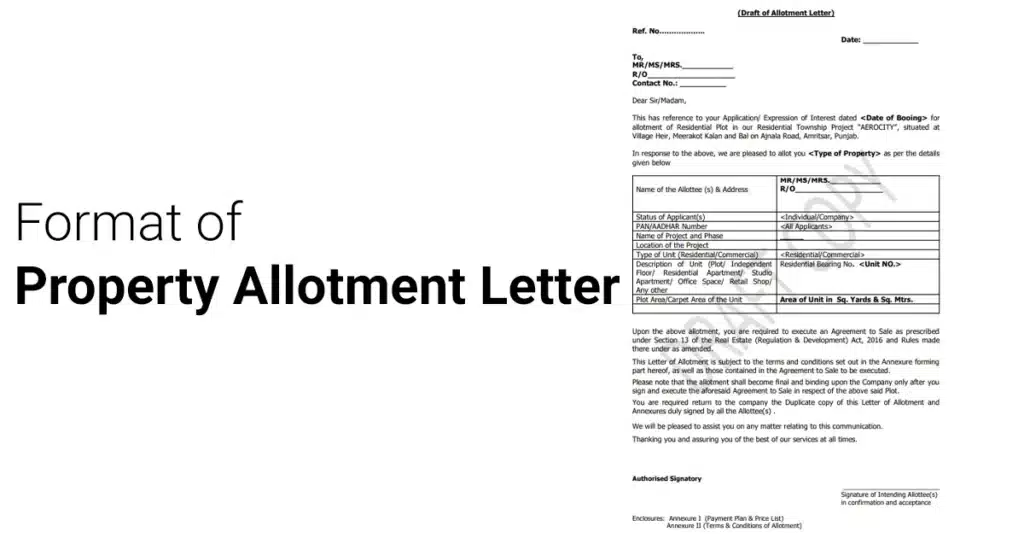

Sample Format of Allotment Letter (with Example)

A standard allotment letter format includes:

[Builder/Authority Letterhead]

Date: [DD/MM/YYYY]

To,

[Name of the Buyer]

[Buyer’s Address]

Subject: Property Allotment Letter for Unit [Unit No.] in [Project Name]

Dear [Mr./Ms. Last Name],

This is to inform you that Unit No. [Unit Number] measuring approximately [Area] sq. ft. located in [Project Name and Address] has been allotted in your favor, subject to the terms and conditions outlined below:

1. Total Cost: ₹[Total Amount]

2. Payment Schedule: As per Annexure A

3. Estimated Completion Date: [Date]

4. Other Charges: [Details]

5. Terms and Conditions: [As Attached]

Please note that the allotment is provisional and subject to timely payments and agreement execution.

Sincerely,

[Authorized Signatory]

[Builder/Authority Name]

[Contact Details]

Points to Remember

- It is very necessary to check the details in the allotment letter, especially unit size details, cost and payment schedule.

- It should be printed on letterhead and should be signed and stamped by the issuing authority.

- Make plenty of duplicates for your bank loan processing, legal verification, and for future purposes.

- The allotment letter holds much importance when a project is under construction because, through this letter, tracking of delivery and fulfillment of obligations can be made possible.

See also: Capital Gains Tax in Bangalore Bring Tremendous Changes in Real Estate Market

Common Mistakes to Avoid with an Allotment Letter

However, these pitfalls cause complications later for many buyers, and here are some of those mistakes to avoid regarding the allotment letter of property:

- Believing it to be proof of ownership– It is only a temporary affirmation and is not a legal title document.

- Not paying attention to details-Failing to carefully check the unit number, size, price, or possession date could spark future conflicts.

- Accepting unsigned or informal documents- Make sure it is on the builder’s letterhead, properly signed, and stamped.

- Not doing this for processing the loan-Since most banks do require allotment letters for the beginning of your home loan application, do this.

- Omitting refund/cancellation terms-Not mentioning charge cancellation or forfeit conditions can result in monetary loss.

- Accepting unclear provisions-Could give rise to legal vagueness and should preferably be checked out.

- Thinking this is final- mostly allotments are provisional and can be cancelled if followed payment schedules are not met.

In other words, treat allotment letters with as much caution as you would any legal document; it sets the tone for all your transactions regarding property.

In the property buying course, allotment may seem another act to suffer, but it is undeniably important. It is the very first formal initiation of your ownership journey, documenting it, ensuring transparency, and enabling financing. While it doesn’t entitle you to ownership just yet, it surely brings you that much closer to securing your dream property.

So, whether it is your first step into buying a home or perhaps your twentieth investment, make sure that this particular allotment letter, from the beginning of the ownership, is all-inclusive, verified, and safely tucked away wherever else you keep your important documents. In the real estate world, documentation is everything.